Environmental review

AREA, STRATEGIC GOALS AND METRICS

Target

12.4, 13.1 and 13.2

Climate action and reduction of GHG emissions

- Delivering on the Climate Agenda project

- Introduction of the internal carbon price

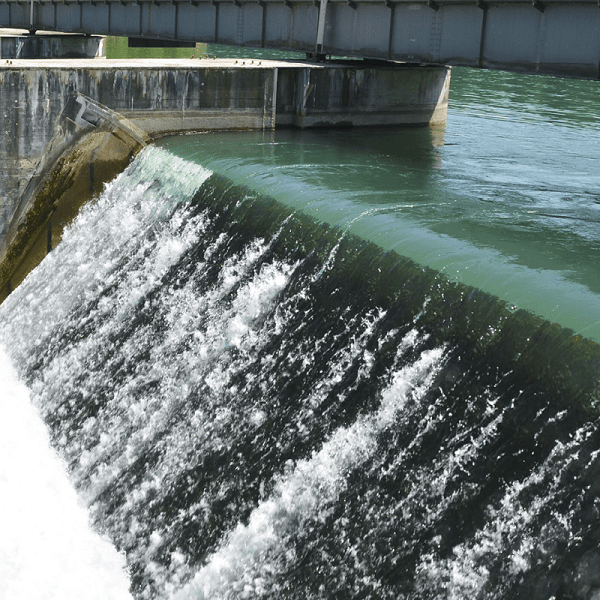

- Contracting TGC‑1 as a supplier of green electricity generated by HPPs

- Assessing the actual impact of the carbon border adjustment mechanism on the Company’s operating expenses and implementing a project to automate calculation of the carbon footprint of products

- Implementing the low‑carbon transition plan

Target

12.4 and 13.1

- Assessing the energy management system for compliance with ISO 50001

- Updating the list of initiatives under the Energy Efficiency Programme

- Upgrading the lighting system to LED

- Installing frequency converters at pumps

- Replacing compressors with more efficient equipment

Target

12.4

Waste reduction

- Enhancing ore processing mechanisms (Kirovsk)

- Using phosphogypsum

- Implementing phosphogypsum conversion at Balakovo branch

Target

3.9, 12.4 and 13.1

Reduction of air emissions

- Installing and modernising gas recovery equipment in upgraded and new shops (Volkhov branch)

- Enhancing dust suppression of dusty surfaces (Kirovsk branch)

- Upgrading the wet‑process phosphoric acid production unit and reconstructing the SK‑20 sulphuric acid production unit

- Upgrading complex mineral fertilizer production

Target

3.9, 6.3 and 12.4

Responsible water use

- Delivering on stage 2 of the Water Use Optimisation Programme (Cherepovets site)

- Implementing initiatives to reduce water consumption at the Kirovsk branch

Target

3.9 and 15.1

Preservation of biodiversity in regions of the Company’s operation at a level securing sustainability

- Development and inception of comprehensive biodiversity protection programmes (Cherepovets site, Volkhov and Kirovsk branches)

- Releasing young fish into water bodies across the Company’s regions of operation

At PhosAgro Group, we attach much importance to environmental protection and safety, as well as climate risk management. Proper focus on all of these areas helps secure the Company’s sustainable development and well‑being of the regions across its geography.

Our Strategy to 2025 provides for strict compliance with statutory requirement on environmental responsibility and practices aimed at minimising the impact of the Company’s operations throughout the whole life cycle of a fertilizer, from mine to food products.

The key priorities set out in PhosAgro’s Environmental Policy are careful use of natural resources and reduction of the environmental footprint.

We had a comprehensive assessment of our operations, determining key focus areas of such impact, both direct and indirect, and weighed it against the UN Sustainable Development Goals (UN SDGs) and national goals.

Based on the assessment results, we mapped out six strategic focus areas of environmental protection:

In 2020, we started implementing the Climate Strategy based on the Company’s vision and expertise in GHG emissions management. The document reviews climate risks and opportunities extensively, setting targets for Scope 1, 2, and 3 GHG emissions and presenting the low‑carbon transition plan.

PhosAgro carries out the Energy Efficiency Programme designed to ensure compliance with the Climate Strategy and the Energy Efficiency and Energy Saving Policy tightly integrated into the Company’s Strategy to 2025.

Strategy to 2025 also seeks to reduce waste generation substantially. Having developed a system for accumulating and analysing data on production and consumption waste from our operations, we are now implementing a range of projects aimed at minimising waste generation and increasing the share of recycled waste.

In the scope of the strategic objectives to reduce air emissions, PhosAgro is running a comprehensive programme to re‑equip production facilities and cut pollutant emissions.

In addition, we developed the Water Strategy in 2020 to minimise our impact on water bodies by means of lean treatment of resources: less water withdrawal and waste water discharge. As part of the Strategy, we assessed water use risks and opportunities, including potential scarcity of water, set targets for water withdrawal and waste water discharge and designed a detailed action plan for each site to achieve the targets.

The Company sticks to its biodiversity management system comprising the assessment of potential impact, interaction with a wide range of stakeholders, as well as monitoring and reporting practices.

We believe that our requirements should be uniform both for us and our partners engaged in PhosAgro’s projects. Everything we require of ourselves equally applies to our counterparties and is enshrined in the Code of Conduct for Counterparties.

Traditionally, we put a special focus on environmental matters and stand in unconditional support of the vulnerable and rare habitats across our geography, leaving them intact and carefully treating natural systems and resources. Our operations undergo a stringent assessment for compliance with the Environmental Policy and the Company’s internal regulations.

Environmental management system

Our environmental management system is integrated in the Company’s overall management framework and is a key element in our approach to managing environmental responsibility.

In 2022, the environmental management system passed a recertification audit across the Company’s production sites and was found to be in full compliance with ISO 14001. In 2023, it successfully underwent an inspection audit under the same standard.

PhosAgro’s environmental management system embraces all management levels and all stages of the product’s life‑cycle, from R&D to manufacturing and finished product application by customers. This approach ensures uniform management requirements across all aspects of the Company’s operations.

The facilities have also put in place a procedure to manage internal audits. Every year, they develop internal audit programmes taking into account the environmental significance of the reviewed processes, changes affecting the facility and previous audit outcomes. The audits provide input data for the Company’s management to analyse environmental management efficiency.

We adopted a unified approach to environmental management that relies on:

Compliance with statutory and regulatory requirements

Environmental compliance is key to running a responsible business.

PhosAgro Group’s environmental management practices ensure our compliance with the applicable environmental and nature conservation regulations and regulators’ decrees. To that end, the Company has in place an internal and external control framework, which includes internal audit and external compliance reviews, a reporting system designed in accordance with legislative requirements, and a staff training system.

All our facilities that have an adverse environmental impact are included in dedicated state registers, with relevant categories assigned to them. PhosAgro has all necessary permits in place for each of these facilities.

None of PhosAgro’s enterprises uses ozone‑depleting substances in the production process. A small amount (not more than 250 kg/year) of carbon tetrachloride (CCl4) is used in laboratory testing.

In 2021, in order to prevent adverse effects of cross‑border handling of Russian chemical products, the Russian Ministry of Industry and Trade initiated a flagship pilot in the chemical sector, which gave rise to innovative development proposals and support measures for exporters of chemical products. The key pilot objectives were to determine the baseline chemical footprint of products and develop a plan to reduce (and, ultimately, eliminate) the negative impact of the used hazardous chemicals on human health and the environment. In 2023, the Company participated in the project to measure the chemical footprint of products.

We do not undertake cross‑border hazardous waste transportation and our production sites are not situated in protected areas. Hence, there are no significant restrictions on our operations.

The Company takes steps to remedy the harm caused by an emergency in 2019 by committing RUB 1,584,000 to the reproduction of aquatic biological resources in 2023.

No audits of Apatit by local bodies of Rosprirodnadzor were held in 2023. There were no administrative proceedings involving the Company, and hence no fines.

In 2023, the increase in the Company’s environmental impact payments was driven by a higher indexation rate used in the calculations. Over‑limit payments accounted for 0.86% of total environmental impact payments (vs 1.22% in 2022). They resulted from exceeding the permissible emission limit for nitrogen oxides by one of the emission sources at the Cherepovets facility.

Assessment, analysis, and monitoring

Continuous improvement is inherent in our environmental management. The Company identifies areas for improvement by reviewing its management system using an effective mechanism, which includes external and internal audits of the environmental management system, activities to monitor and assess the Company’s performance, including by a wide range of stakeholders, and the analysis and assessment of PhosAgro’s performance by the Company’s management. These efforts enable us to work out corrective action plans and proposals on how to develop and improve the system.

Stakeholder engagement is essential for the Company’s planning. Public discussions are a legitimate and effective mechanism for establishing dialogue with stakeholders using a discussion platform to express their opinions and make suggestions on the initiatives under consideration. This mechanism has a positive impact on the decision‑making process and improves its efficiency. Engaging the general public and a wide array of stakeholders in discussion plays an important role and helps ensure that all points of view are considered.

When assessing the Company’s performance, much attention is paid to the analysis of ESG ratings and investor feedback.

Environmental risk management is an integral part of the Company’s risk governance framework. The general approaches to managing risks are set our in the Strategic Risks section.

The following strategic risks affect our environmental protection objectives

For more information, see the Strategic Risks section.

The environmental protection risks include

Our targets

2023 highlights

PhosAgro has LEAD status under the UN Global Compact and is a participant of the Climate Ambition initiative.

Starting 2021, the Company has been making annual climate disclosures in line with the TCFD standards and key requirements of the new IFRS S2, which enables the most thorough disclosure of the climate‑related aspects of PhosAgro Group’s strategy, risks and opportunities, management approach, results, and indicators.

The Company’s representatives are members of climate change and sustainable development task and expert groups instituted by government authorities and non‑governmental organisations, and are actively engaged in discussions on current global challenges.

Strategy and management approach

The Company focuses on climate change in line with the double materiality principle: on the one hand, it identifies and assesses the impact of its operations on climate all along the value chain from extraction of raw materials to consumption of finished products. On the other hand, it projects how climate change affects PhosAgro’s business, strategy, and financial planning.

Climate matters feature prominently in PhosAgro’s strategic and investment decisions, as well as in its day‑to‑day management. For instance, in the reporting year, we applied the internal carbon price mechanisms developed in 2022 in the evaluation of investment projects. The Company has identified, assessed, and prioritised climate risks, establishing their short, medium and long term consequences for its production and business processes. We make our strategic plans and day‑to‑day management decisions with full awareness of the nature and extent of climate impact (both environmental and political) on the Company’s business, strategy, and financial planning. The Group develops and takes consistent steps to reduce its carbon footprint and closely interacts with partners across its value chain (suppliers and consumers) and other stakeholders domestically and worldwide.

PhosAgro’s Climate Strategy was adopted in 2020. It is a comprehensive document setting out the Company’s climate policy in the face of growing climate change and uncertainty.

Main principles of PhosAgro Group’s Climate Strategy:

- setting up targets to reduce GHG emissions in line with the Science Based Targets initiative; using climate scenario analysis;

- integrating climate risks into the comprehensive risk management framework for investment and day‑to‑day business activities;

- utilising technology‑related measures along with proper organisation and management, as well as sound social and personnel policy, to reduce GHG emissions;

- identifying not only risks, but also attractive climate‑related investment opportunities and making long‑term plans for them;

- promoting awareness of the Company’s climate initiatives and plans, as well as cooperation in specific areas;

- engaging stakeholders to reduce GHG emissions along the value chain.

The Strategy has set the following goals:

- to minimise GHG emissions while increasing output;

- to improve energy efficiency and environmental performance of the key production processes;

- to reduce energy and carbon intensity per unit of output;

- to develop innovative fertilizers and efficient plant nutrition systems to reduce Scope 3 GHG emissions from the use of fertilizers by farmers;

- to enter into new emerging markets for green products;

- to retain and expand the existing market niches by ensuring PhosAgro Group’s competitive edge in terms of energy and carbon intensity.

The Company is currently focused on creating particular metrics reflecting the impact of climate action in production and management processes on financial indicators. To that end, we assessed the impact of the carbon border adjustment mechanism EU CBAM on PhosAgro’s operating expenses. The mechanism covers Russian industrial products, including mineral fertilizers. In 2023, the Company established a working group responsible for developing a way to assess the carbon footprint of products under the EU CBAM . The working group created an effective mechanism to measure carbon footprint per each tonne of fertilizer based on a transparent calculation methodology for GHG emissions, which covers production processes and semi‑product flows fully in line with the CBAM guidelines.

Low‑carbon transition plan

The low‑carbon transition plan was developed in 2020 based on the specialised research data and aims to support economic development of PhosAgro Group that builds on the priority of keeping GHG emissions to a minimum. It is implemented to ensure that the GHG emission reduction targets are delivered across all scopes.

Actions to deliver the Climate Strategy

In 2023, we continued to implement initiatives under the climate project.

The Company’s experts continued to explore options for absorbing greenhouse gases in order to select the most suitable ones. In 2023, we also launched the Carbon Footprint Compensation project aimed at absorbing (compensating for) GHG emissions, with a carbon footprint compensation farm being set up in the Vologda region. In 2023, we planted additional 10 thousand coniferous and 15 thousand.

As part of the project implementation in 2023, the Company developed and approved:

- guidelines and methodology for calculating the carbon footprint of products (validated by a reputable international certification authority);

- carbon footprint calculation methodology compliant with the EU carbon border adjustment mechanism;

- a mechanism for the transition to low‑carbon energy sources and acquisition of green energy;

- rules for using the internal carbon price (adopted and put to use).

Risks and opportunities

PhosAgro identifies its climate risks and opportunities based on climate change. The process is influenced by physical (changes in natural processes or phenomena) and transitional factors of various nature (changes in the policy and regulation with a view to fulfilling low‑carbon transition).

Risks

R1 – disruptions in production processes and logistics operations due to increasing acute climatic effects and other climate‑related factors.

R2 – flaws in supply chains, construction design, health and safety; negative environmental footprint and reduced flows of ecosystem services; lower resilience of infrastructure and communications due to increasing climatic effects.

R3 – PhosAgro Group’s failure to comply with regulations reducing its negative environmental footprint (following the adoption of the carbon border adjustment mechanism).

R4 – deterioration of the Company’s sustainability reputation.

R5 – increased costs and losses (as a result of customers’ failure to meet their obligations, rising prices for feedstock, materials and services, higher borrowing rates) and shrinking revenues (as a result of a decline in sales, customers, countries and regions of operation).

Opportunities

O1 – boosting PhosAgro Group’s appeal as an environmentally and climatically responsible supplier of products with a positive climate profile.

O2 – improved logistics driven by the new export opportunities amid shortened seasonal freeze‑up of rivers and lakes due to climate change.

O3 – new financial products that open up new sources of cheaper funding (such as green bonds) for companies that embraced environmental and climate sustainability.

As part of our comprehensive risk management framework, we identify, assess and manage climate risks. Covered value chain stages – direct operations up and down the value chain. Climate risk management process is baked in the company‑wide risk management processes.

Climate scenario analysis

The Company views climate scenario analysis as a tool to make its climate strategy resilient to uncertainties and risks related to climate change. As part of the climate strategy development in 2020, we adopted climate scenarios and determined respective scenario parameters that are most probable and significant for the Company in the short, medium and long term.

PhosAgro Group assessed the impact of climate‑related risks and opportunities on its operations under two climate change scenarios: global warming of 2°С and 4°С. The key features of the scenarios are:

- 2°С scenario is expected to result in stringent climate policy measures that will increase market volatility (goods, services, finances, etc.). This is projected to bring about low‑carbon transition, putting in place mechanisms of a low‑carbon economy that will slow down physical climate‑related impacts going forward;

- 4°С scenario is expected to result in less stringent climate policy measures as compared to the 2°С scenario, triggering faster physical climate‑related changes.

Experts assessed the 2°C scenario as the most probable, hence it was selected as the basis for setting targets, evaluating risks and opportunities, and developing plans under the low‑carbon transition.

PhosAgro identified projected changes in climate risks and opportunities under the adopted climate scenarios based on risks, opportunities, scenario parameters, and time frames. In doing so, the Company focused on its operations, strategy, and financial planning.

Processes to identify and assess climate change risks are being integrated throughout the value chain – from design, procurement and apatite‑nepheline ore mining to finished product delivery.

Key initiatives in 2023

Plans for 2024

Metrics and targets

PhosAgro’s climate metrics are aligned with the goals of the Climate Strategy approved by its Board of Directors.

The Company is working to expand and enhance the quality of climate‑related measurements. Most metrics are locked on targets which are aligned with the goals of the Climate Strategy and other commitments of the Company.

The metrics are monitored and reported annually to stakeholders.

The Company’s primary focus is on GHG emissions (carbon dioxide CO₂, methane CH4 and nitrous oxide N2O) in all three Scopes (1, 2, and 3). The Company calculates greenhouse gas emissions in accordance with the international guidelines:

- 2006 IPCC (Intergovernmental Panel on Climate Change) Guidelines for National Greenhouse Gas Inventories;

- the Greenhouse Gas Protocol: Scope 2 Guidance;

- the Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (Revised Edition);

- ISO 14064‑1 – Specification with Guidance at the Organisation Level for Quantification and Reporting of Greenhouse Gas Emissions and Removals.

Calculations are based on global warming projections of the IPCC report “Climate Change 2021: The Physical Science Basis”.

The Company’s efforts include end‑to‑end monitoring of raw data (Scopes 1, 2, and 3) and analysis of supply chain participants’ data (Scopes 2 and 3).

The targets are set in line with minimum qualitative and quantitative criteria based on RCP 2.6, a representative concentration pathway for reduction of global anthropogenic emissions, in order to keep global temperature rise below 2°C by 2100.

Greenhouse gas emissions were calculated in line with the Guidelines for Climate Impact Management of PJSC PhosAgro and other Group Entities (using the IPCC methodology).

Energy indirect GHG emissions (Scope 2) are related to the production of electricity and heat brought in from third parties to meet the Company’s needs.

In 2022, we changed our approach to calculating Scope 2 GHG emissions related to electricity consumption. In 2020–2021, the methodology relied on emission factors defined by the International Energy Agency (IEA), while starting 2022, we use the energy indirect GHG emission factor for the First Synchronous Zone of the Russian Energy System defined by the Trading System Administrator of the Wholesale Electricity and Capacity Market.

Scope 3 greenhouse gas emissions were calculated for four categories after an expert review identified them to be the most significant emission sources for the Company.

We have chosen 2018 as the base year for calculations because it was the Company’s first GHG inventory year and we needed to set GHG reduction targets for all three scopes based on the available emission data. In 2018, GHG emissions were as follows: direct GHG emissions (Scope 1) – 4,624.6 kt of CO2‑eq., indirect GHG emissions (Scope 2) – 924.1 kt of CO2‑eq., and other indirect GHG emissions (Scope 3) – 11,413.8 kt of CO2‑eq. In 2023, per unit GHG emissions (Scope 1) declined by 21.9 kg/t or 14.6% compared to 2018, driven by growing output, whereas gross GHG emissions (Scope 1) increased by 3% vs 2018. Excluding the output growth factor, gross emissions decreased by 815 kt compared to 2018. The mix of semi‑finished products used in fertilizer production had the most significant impact on the reduction of Scope 1 GHG emissions, as part of direct emissions related to manufacturing of semi‑finished products decreased due to replacing some of the Company’s own products (for example, ammonia) with third‑party feedstock.

Per unit GHG emissions (Scope 2) declined by 25.8% compared to the baseline year of 2018, while gross GHG emissions (Scope 2) (excluding the output growth factor) decreased by 288 kt vs 2018. The reduction was achieved thanks to the green electricity procured by the Kirovsk branch of Apatit, as well as energy efficiency initiatives.

Total GHG emissions (Scope 3) increased by 19.2% vs the baseline year. Key growth drivers in 2023 were as follows: an increase in the volumes of purchased feedstock and fuel consumed at subsidiaries and affiliates that are not included in Scope 1 and Scope 2 emissions, as well as higher product sales. Excluding the output growth factor, Scope 3 GHG emissions declined by 205 kt vs the baseline year.

Our targets

2023 highlights

In 2023, the Company implemented a comprehensive project to assess the energy management system for alignment with best practices and ISO 50001. The assessment covered all of the Company’s production facilities where teams combining external experts and key employees of each facility performed an in‑depth analysis of processes, risks, and opportunities, identified growth areas, and developed action plans to tackle bottlenecks. The assessment findings were thoroughly analysed and submitted for the management’s consideration.

In order to better understand the processes and complex elements of the energy management system, employees and managers underwent relevant training with inputs from external experts.

In 2023, PhosAgro’s executives resolved to establish a stand‑alone unit within the Company responsible for building a unified energy management system, setting targets for reducing energy consumption, and managing changes as part of the continuous improvement of the energy management system.

In the reporting year, the amount of electricity generated internally by heat and power plants in Cherepovets, Balakovo, and Volkhov went up 10% y‑o‑y.

As a result, the Company’s production facilities were 42.5% self‑sufficient in terms of electricity needs in 2023 (vs 42.9% in 2022, flat y‑o‑y).

Going forward, the Company will continue developing in‑house power generation. A project to build a new exhaust gas turbine at the Balakovo branch is currently at the design stage.

In 2023, we completed tests of a solar power generation technology at the Company’s facility in Balakovo. With the manufacturer’s lab completing an extensive study of the prototype solar panels, which had operated at the facility for 18 months, PhosAgro gained important knowledge essential for the technology’s further roll‑out across the Company’s facilities.

Strategy and management approach

In 2023, the Company continued to follow the Climate Strategy and the Energy Efficiency and Energy Saving Policy approved by the Board of Directors. We reviewed and updated the list of initiatives set out in the Energy Efficiency Programme, which is tightly integrated into the Company’s Strategy to 2025.

The Energy Efficiency and Energy Saving Policy sets out the following key goals:

The Company pays particular attention to managing energy efficiency risks.

A sufficient and reliable energy supply is a material aspect and major concern for us. We thoroughly explore all opportunities to transition to renewable energy: among other things, in 2023, we continued to purchase electricity generated by hydroelectric power plants.

Risk of Scope 2 GHG emissions to be included in carbon regulation in the EU and other jurisdictions. The Company’s energy efficiency directly affects Scope 2 GHG emissions, which poses a potential risk, for example after full‑scale implementation of carbon border adjustment mechanisms.

Market availability of electricity from renewable energy sources. The Company continuously monitors the market to ensure a sufficient supply of electricity from renewable energy sources.

The initiatives set out in the Programme are aimed at improving energy efficiency, developing energy management at each production site, and achieving objectives in the following focus areas:

- in‑house power generation through utilisation of sulphuric acid production steam;

- introduction of technologies aimed at loss reduction and energy savings (e.g. LED lighting, frequency converters, less heat energy losses).

In addition, the Company actively studies and tests promising solutions, including by increasing the share of renewable energy sources both as part of pilot projects at PhosAgro’s own facilities and through green electricity purchases.

In 2023, we implemented comprehensive energy efficiency projects at all of our sites.

Key initiatives in 2023

Initiatives planned for 2024

Metrics and highlights

The energy efficiency metrics are used to monitor the Company’s progress towards its energy efficiency improvement target and are set forth in PhosAgro’s Energy Efficiency Programme and Action Plan, which helps keep track of electricity generation and consumption, energy intensity, etc.

The energy efficiency metrics are based on PhosAgro’s raw data and are calculated in accordance with the approved statistical methodologies. The Company prepares its energy efficiency reports in accordance with the GRI 302: Energy 2016 standard.

Total electricity consumption is attributable to the expansion of the processing facilities.

In 2023, the volume of carbon‑free electricity used in the production of phosphate rock at the Kirovsk branch grew to 300 mln kWh. Thus, about 18.3% of the plant’s output is covered by green electricity generated by the hydroelectric power plants of TGC‑1.

Target

2023 highlights

Strategy and management approach

PhosAgro’s Development Strategy to 2025 stipulates an increase in the share of recycled hazard class 1–4 waste to 40%.

Having developed a system for accumulating and analysing data on production and consumption waste from our operations, we are now implementing a range of projects aimed at minimising waste generation and increasing the share of recycled waste.

PhosAgro’s waste management is monitored on a regular basis and discussed by the Strategy and Sustainable Development Committee before being communicated to the Board of Directors.

The management system covers:

Key initiatives in 2023

Consistent efforts to grow the share of recycled and decontaminated hazard class 1–4 waste, which helped increase recycling and decontamination of relevant waste in 2023.

Collecting used bags (fertilizer packaging waste) from PhosAgro‑Region’s customer farmers and their further processing into recycled feedstock for new packaging sacks (in collaboration with Chempack).

Promotion of phosphogypsum

Balakovo branch equipped road and rail loading areas for phosphogypsum, which is used as an ameliorant agent in farming.

We keep testing this new product to discover its different applications. For instance, in 2023, we held a series of trials of neutralised phosphogypsum on acidic soils together with Pryanishnikov Institute of Agrochemistry and Saratov State Agrarian University. The trial findings were comparable to the results of lime treatment, while the application rate per 1 ha was three times lower.

We also tested the safety of phosphogypsum used as a component for cattle and poultry bedding. Bedding with phosphogypsum content is 20% dryer. It also serves as a sulphate‑based disinfectant, which helps reduce the number of mastitis cases and paw and hoof diseases by 50%.

Phosphogypsum was also tested as an ameliorant for urban areas reducing the deterioration of soils and perennial plants caused by anti‑icing reagents, which are primarily based on sodium salts (toxic for plants). Phosphogypsum offsets the salt effect and preserves urban soils and vegetation.

An important driver behind the further expansion of phosphogypsum use in Russia’s agriculture is its inclusion on the list of subsidised products (for plastering of solonetz soils) as part of the Amelioration Development and Soil Fertility Preservation Programme starting 2024.

We also promote the use of phosphogypsum in construction. To that end, we implement a joint project with two large cement plants – Volga‑Cement and Cementum, Saratov region – to partially replace natural gypsum with phosphogypsum in cement production.

Phosphogypsum application in road construction is also gaining momentum. For instance, commercial organisations and agricultural producers use it to build private driveways, ramps, manure storage areas, etc. They apply hemihydrate phosphogypsum to reinforce soils and produce durable road pavement (similar to lean concrete) for category 3–5 roads. Phosphogypsum improves road throughput capacity, doubles permitted axle load, boosts rutting resistance, and prevents soil heaving during abrupt changes in temperature thanks to its low thermal conductivity.

In addition to expanding phosphogypsum sales geography (for instance, PhosAgro plans to start shipping it to the Volgograd, Astrakhan, Penza and Tambov regions, and the Republic of Udmurtia), the Company’s plans for 2024 include active promotion of phosphogypsum in urban soil amelioration, road repairs and construction, and production of building blocks and paving slabs (relevant trials are currently in progress). On top of that, together with the Scientific Research Institute for Road Construction, we started developing a technical certificate (preliminary national standard) for phosphogypsum used in road pavement and soil reinforcement.

Metrics and highlights

The reduction in class 5 waste generation was due to lower generation of waste from mining at the Kirovsk branch resulting from reduction of mining operations on the back of better excavation quality.

The decrease in indicators is due to:

- The formation of rocks duringunderground works on sections that do not contain valuable minerals decreased due to the higher quality of mining techniques, driving waste generation down.

- The increase in hazardous waste generation of classes I-IV at Balakovo branch was due to large-scale cleaning of treatment facilities.

Our targets

2023 highlights

RUB 4 bln was invested throughout the duration of the Clean Air Initiative,

Strategy and management approach

PhosAgro Group has developed and now maintains an emissions management process that includes assessment of planned activities, discussion of relevant matters with a wide range of stakeholders, as well as monitoring and disclosing pollutant emissions. To effectively reduce its environmental impact, PhosAgro is running a programme to re‑equip production facilities and cut pollutant emissions.

PhosAgro takes part in the government’s Clean Air initiative, which aims to drastically reduce air pollution in major industrial cities across Russia. As part of the initiative, the Company implemented a number of measures at its Cherepovets site, which helped reduce per unit pollutant emissions by 20.5% vs the 2017 level (project launch) as early as in 2023.

Air quality in sanitary protection areas near the Company’s production sites complies with applicable hygienic requirements.

Key initiatives in 2023

Apatit’s Cherepovets site implemented four out of five planned activities as part of the Clean Air national project.

At the Volkhov branch, the key activities of 2021–2023 to reduce the negative impact on the environment, including air, were implemented as part of an investment project to develop the Volkhov site: technical solutions to reduce per unit emissions and concentrations of pollutants at the sanitary protection zone boundaries near residential areas were provided for back at the stages of new construction and upgrades. The considerable reduction in per unit emissions confirms that we have chosen the right approach.

At the Balakovo branch, upgrade of the wet‑process phosphoric acid production unit and reconstruction of the SK‑20 sulphuric acid production unit in 2023 were implemented in combination with a revamp of gas recovery equipment, which ensured the reduction of per unit pollutant emissions to the atmosphere.

At the Kirovsk branch, the 2023 activities to minimise dust emissions from tailing dumps of beneficiation facilities included:

- chemical stabilisation using binding agents (PSKh‑18, Lukoil, bitumen emulsion) for dusty surfaces in the beach area of tailing dumps:

- at apatite‑nepheline beneficiation plant 2 across 443 ha,

- at apatite‑nepheline beneficiation plant 3 across 557 ha;

- chemical stabilisation for dusty surfaces on service roads of tailing dumps:

- at apatite‑nepheline beneficiation plant 2 across 88 ha,

- at apatite‑nepheline beneficiation plant 3 across 109 ha;

- extra nutrition of crops planted in the past years on the dam slopes and in the beach area of tailing dumps across 30 ha;

- covering operating roads of the tailing dump at apatite‑nepheline beneficiation plant 3 with crushed stone across 50 ha;

- piloting five new anti‑dusting agent prototypes.

Metrics and highlights

Our targets

2023 highlights

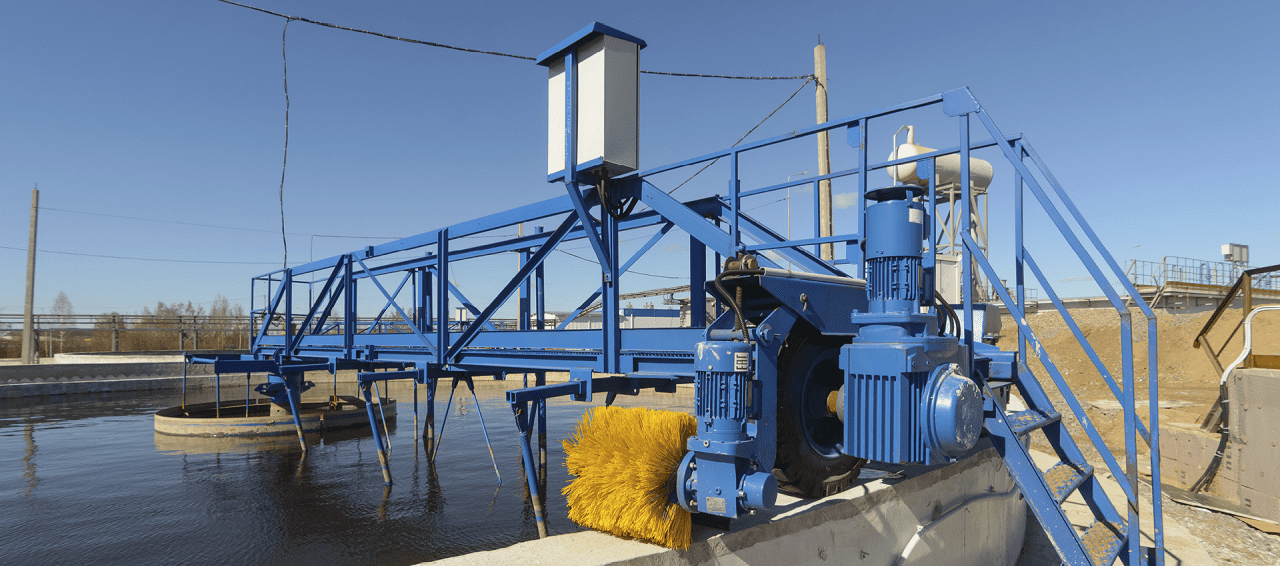

Strategy and management approach

Water is an essential resource for the Company. There is no shortage of water sources in the regions where our facilities are based. According to the Water Risk Atlas and Water Risk Filter, all PhosAgro production sites are located in areas with low or moderate fresh water scarcity. However, access to clean water is a major issue facing the world.

Risks and opportunities

The main risks related to water consumption are water quality deterioration in water bodies across PhosAgro’s footprint and the Company’s non‑compliance with statutory requirements for limiting one’s negative impact on water bodies.

PhosAgro has implemented closed‑loop water recycling systems at its sites in Volkhov and Balakovo to reuse water in production processes.

Going forward, we plan to improve waste water management by focusing on maximum reuse of water through closed‑loop water recycling systems and better treatment of effluents discharged into water bodies in addition to ongoing monitoring of water bodies in the regions of operation.

The regulatory risks include tightened waste water quality requirements, as well as restrictions on the amount of water consumed and discharged into both water bodies and centralised waste water systems. There were no incidents of non‑compliance associated with water quality permits, standards, and regulations in 2023.

To mitigate these risks, in 2020 we adopted the Water Strategy that sought to reduce water consumption and discharge and improve waste water quality.

The strategy is implemented at all PhosAgro sites, and we regularly analyse these measures to determine whether they are sufficient and effective enough to achieve our targets.

To identify the impact of the Company’s operations on water bodies, we monitor these bodies in accordance with adopted programmes by engaging our own certified laboratory and external certified laboratories.

Key initiatives in 2023

At the Cherepovets site, we continued to implement the second stage of the water use optimisation programme as part of our production upgrade initiative for 2020–2025.

Phosphate facility:

1

A base case design developed for A Waste Water Treatment Unit with a Source Water Capacity of at Least 400 m3/h. Design works on the facility (construction, networks, auxiliary systems) are in progress;

2

Key technical solutions implemented; design works are in progress for the Technical Upgrade of an Acidic Waste Water Treatment Station with Production Capacity Increase;

3

The development of engineering documentation completed for A Saline Waste Water Sewerage at the Phosphate Facility of Apatit.

4

Engineering documentation implemented for The Technical Upgrade of a Water Treatment Station in a Utility and Drinking Water Supply System with Arrangements Made to Dehydrate Sludge Water.

Nitrogen facility:

1

A base case design implementation in progress for a waste water treatment unit at the nitrogen facility of Apatit (until 4Q 2024).

2

Engineering surveys and design works in progress for the system of reception and accumulation, transportation and treatment of industrial waste water (industrial waste water neutralisation and treatment 1); priority actions for the system upgrade were scheduled.

At the Kirovsk branch, measures are taken to reduce water consumption:

- Using the Saami pit water for process needs at the Kirovsky mine workings;

- Reconstruction of the Kirovsky and Rasvumchorrsky mines’ compressor stations.

Metrics and highlights

Our targets

2023 highlights

Strategy and management approach

The Company’s Environmental Policy sets forth PhosAgro’s obligations to preserve biodiversity, natural landscapes and habitats across its footprint and prevent its projects from causing any harm to the same.

Before building any new production facilities or renovating existing ones, PhosAgro conducts an environmental impact assessment (EIA) based on the results of engineering and environmental surveys. Assessment of the local flora, fauna and landscapes, as well as research, analysis and consideration of public attitudes towards biodiversity protection are integral to our EIA procedures.

Key initiatives in 2023

For a number of years, the Company has been conducting research to develop biodiversity protection programmes, including the evaluation of the current state and development of a list of indicators for future biodiversity monitoring.

Going forward, we plan to integrate the comprehensive biodiversity programmes of the Company’s branches into a single system based on a unified approach to assessment and monitoring. This work is underway and it will be finalised as we complete research projects at each of PhosAgro’s assets.

For a number of years, the Company has been working to preserve biodiversity and replenish biological resources. Since 2020, the Company has been developing comprehensive biodiversity protection programmes in partnership with research institutions. The effort is aimed at assessing and restoring environmental conditions across the Company’s footprint and establishing its priorities in protecting biodiversity based on indicator species monitoring.

Comprehensive biodiversity protection programmes

Comprehensive biodiversity protection programmes were developed for the Volkhov branch, two of the Kirovsk branch’s facilities and the Cherepovets production site.

In 2022, we completed a comprehensive environmental study of the area within the footprint of the Kirovsky mine. As part of the efforts to develop biodiversity protection programmes in 2023, the Company joined forces with the Kola Science Centre of the Russian Academy of Sciences to conduct a comprehensive environmental study of the area within the footprint of the Rasvumchorrsky mine (Kirovsk branch, Murmansk region).

The research revealed that the biota of terrestrial ecosystems within the footprint of the Rasvumchorrsky mine includes over 650 species of fungi, liverworts, lichens, mosses and vascular plants, as well as 135 bird and 12 mammal species. The diversity of bird and mammal species was strongly affected and disturbed by human activities in the area. The study also found four fish species within the footprint of the Rasvumchorrsky mine. Lake Bolshoi Vudyavr currently fits the habitat requirements for these species, as it offers ample food supplies for both salmonids (brown trout, Arctic char) and European smelt.

In 2024, we plan to launch a comprehensive environmental study of the area within the footprint of the Vostochny mine.

Metrics and highlights